Tax loss harvesting can be used in taxable brokerage accounts to maximize legacy giving impact.

In previous blog posts, I’ve discussed various tax-advantaged accounts that can help you build your legacy, both for charitable giving purposes and to pass along to heirs. But what if you’ve maxed out these savings vehicles and still have discretionary income you wish to save? In this case, you may find yourself making more contributions to a regular, taxable (non-tax advantaged) brokerage account.

While taxable brokerage accounts don’t provide the same tax advantages as accounts such as 401ks or IRAs, there are still strategies that you can use here to leverage these accounts and maximize your legacy giving return on investment (ROI), one of which is tax loss harvesting.

What is Tax Loss Harvesting?

Tax loss harvesting is a strategy in which you sell securities at a loss, and then use those losses to offset taxes from gains. Think of it as an opportunity to make lemonade out of lemons.

Tax loss harvesting often comes up as the end of the year approaches, since you must lock in losses prior to the end of the tax year. The deadline for realizing a capital loss is December 31st, though capital losses over a certain amount may be eligible to be carried over into future years (we’ll discuss this in more depth later in this post.)

Purchasing Securities in a Taxable Brokerage Account

To understand how tax loss harvesting works, we need to start with how purchases of securities are made in a taxable brokerage account and the difference between average cost and specific identification.

As you make contributions to a regular, taxable brokerage account, you will buy a given security (let’s assume stock/equity mutual funds for the moment) on different dates over time. This means you’ll have several lots, which are just the same security purchased on different dates, typically with different purchase prices due to market fluctuation.

In taxable brokerage accounts, lot-level trading features prominently in strategies for lowering taxes and maximizing charitable giving impact.

The cost basis for these lots may be either – “Average Cost” or “Specific Identification”. With average cost, every time you sell a security, the average cost basis across all the lots of that security is used to determine the taxable gains being realized. With specific identification, you are able to specifically identify which lots to sell to produce the desired tax consequence.

Most brokerage firms default your cost basis election to average cost, but you have the option of changing the cost basis election to specific identification. To take advantage of tax loss harvesting strategies, you therefore must change your cost basis election with your brokerage firm, but I would argue it’s usually worth it.

An Example of Tax Loss Harvesting

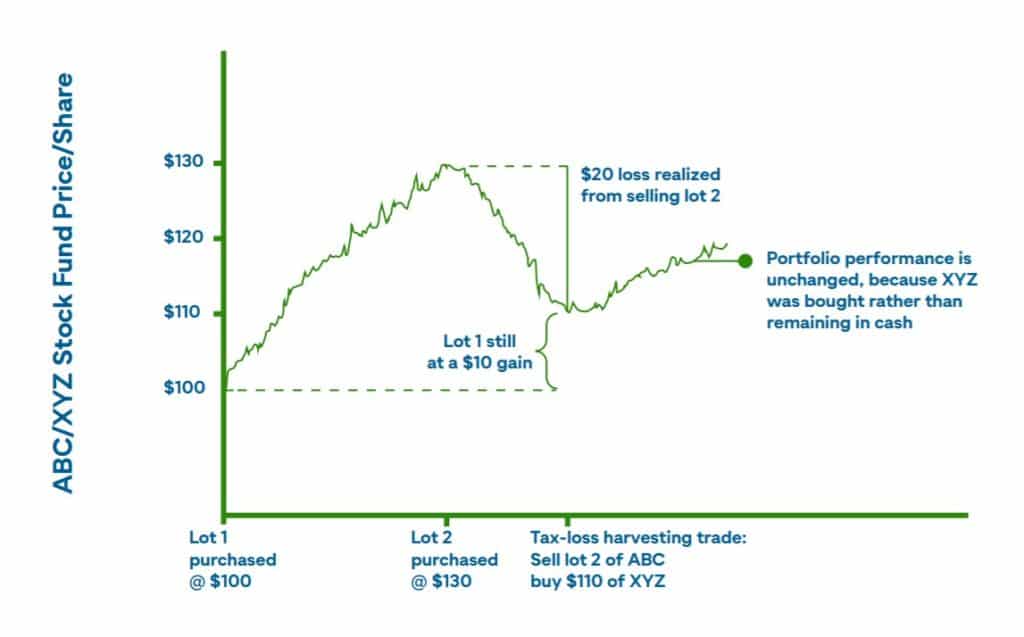

Let’s say you purchase ABC stock fund for $100/share today. Next year, it goes up to $130/share, and you purchase another lot at that price. Then, over time, it falls back down to $110/share. The first lot, with the cost basis of only $100, still has unrealized gains of $10/share, while the second lot has unrealized losses of $20/share. In this scenario, with “Specific Identification” elected, we can sell the second lot and lock in that $20/share loss to reduce your taxable income.

Capital losses harvested in this way can be used as a deduction against ordinary income (income taxed at the regular tax rate), up to $3,000 per year, while the rest can be used to offset capital gain income. While any deduction could prove beneficial, since I’m all about making the most of every dollar, I will take a moment to quickly point out that ordinary income is taxed at higher rates than capital gains. For example, in 2021, if you’re a married couple filing jointly and you have an annual income of $200,000, your income tax rate is 24%. In contrast, your capital gains tax rate is 15%.

How to Avoid a Wash Sale

Now, in tax loss harvesting scenarios like above, you can’t purchase back into ABC stock fund within 30 days, or the IRS considers it a wash sale, and the loss is disallowed, meaning you cannot write off the investment loss.

If you use the proceeds from selling a security at a loss in a taxable brokerage account to purchase the same investment in a different account (including a tax-advantaged account), it’s still considered a wash sale. You also can’t get around the rule by having one spouse sell the security and another purchase the security.

So, if none of these options work, how can you avoid a wash sale?

Well, you could wait 31 days, but then you’re leaving those sale proceeds sitting in cash and missing out on any potential recovery. The workaround is to use the proceeds to purchase into a surrogate fund – let’s call it XYZ stock fund – that is substantially similar, but different enough to get around the wash sale rules.

This allows you to lock in the losses from a tax perspective, but not from an investment perspective – it’s like having your cake and eating it, too! Then, after that 30-day wash sale window has closed, you can always choose to unwind this trade and move back into the original ABC stock fund.

Capital Loss Carryforward

The maximum amount of capital losses you can deduct in a single tax year is $3,000, but if your capital losses exceed this amount, that doesn’t mean you can’t deduct them at all. Any losses leftover after offsetting ordinary and capital gain income can then be carried forward into future tax years indefinitely, which can help offset gains and ordinary income in future tax years.

So, let’s say in 2020 you have a regular, taxable brokerage account with $3,000 of realized gains, but a specific stock fund in your portfolio with $10,000 in unrealized losses. By selling that stock fund, you lock in the losses. You could deduct $3,000 from your taxable income, offset the $3,000 of realized gains, and have $4,000 you could carryover into future tax years.

These harvested losses help to minimize taxes, again helping to create more wealth surplus that can be used for legacy giving.

The Takeaway

If your tax planning only considers the impact of taxes on tax-advantaged accounts, you’re missing out on opportunities to grow your wealth and maximize your legacy giving ROI.