For those who prioritize a charitable legacy but also seek to minimize longevity risk, Charitable Remainder Trusts (CRTs) may be the answer.

Those of us with strong charitable legacy goals often must balance our charitable desires with our need to account for longevity risk (i.e., the risk of outliving our assets’ ability to support us). This is a challenge for individuals regardless of income level, and one that is integral to consider when thinking about estate planning. One option for handling this challenge is a Charitable Remainder Trust (CRT).

What is a Charitable Remainder Trust?

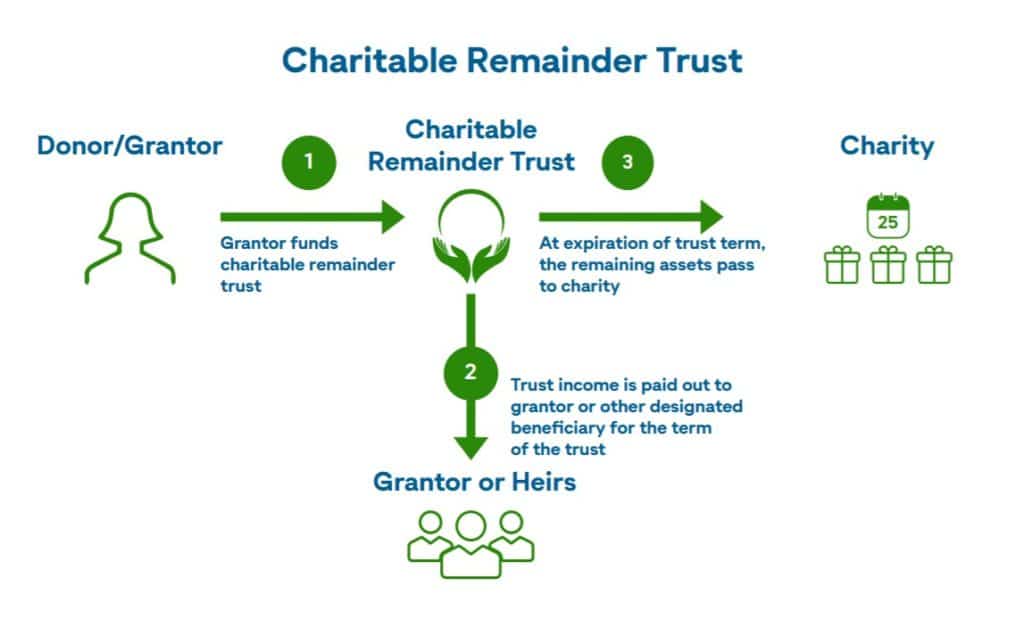

A Charitable Remainder Trust (CRT) is a type of split interest trust, which means the trust’s assets are split to serve the needs of multiple parties, in this case, both charitable and non-charitable beneficiaries.

A CRT allows you to take assets such as stocks or real estate and turn them into income that you can use for the rest of your life, but a CRT is not just about creating an income stream. CRTs are also tax-efficient; decreasing current income taxes and future estate taxes and its tax-exempt status eliminates the capital gains taxes due when the assets in the trust are sold. Additionally, as the name implies, CRTs also have a charitable component, which allows you to support a charity (or charities) of your choosing.

How Does a Charitable Remainder Trust Work?

To create a CRT, you first transfer appreciated assets (assets whose value has increased over time, such as stocks or real estate) into an irrevocable trust.

Next, the trustee sells the assets in the trust and uses those funds to purchase assets that produce income. As previously noted, these assets are exempt from capital gains taxes. This saves the grantor the capital gains taxes from selling that appreciated property on his or her own, as well as providing an immediate charitable income tax deduction equal to the present value of the expected remaining assets that will pass to charity.

The effect of these tax savings means the grantor is likely to receive more annual income from assets placed into the trust than if he or she had not funded the trust, especially in low interest rate environments. Additionally, funding an irrevocable trust like a CRT shrinks the grantor’s taxable estate, thereby minimizing exposure to transfer taxes. It also shrinks the probate estate (i.e., the portion of the estate passing through probate), so fewer assets can be contested by heirs or claimed by creditors.

For the rest of your life, the trust then pays you either a fixed sum or fixed percentage of the trust assets, depending on the type of trust (which we’ll compare in the next section).

Finally, upon your death, the remainder of the assets in the trust are donated to the charity (or charities) of your choosing. This is what is meant by split interest – one interest is providing income that lasts throughout your lifetime and the second interest is charitable giving.

The Two Types of CRTs

CRTs can either be categorized as a Charitable Remainder Annuity Trust (CRAT), which pays out a fixed sum annually to the income beneficiaries, or a Charitable Remainder Unitrust (CRUT), which pays out a fixed percentage of the trust assets annually (meaning the payments can fluctuate depending on investment performance of the trust assets).

A CRUT is generally more flexible, as it allows you to make additional funding contributions to the trust over time, if you so desire. A CRUT also allows for a variety of creative planning opportunities to delay income – for instance, until retirement when a grantor’s taxable income is lower, or until such a time as the grantor moves from a high-income tax state to a lower-income tax state.

Charitable Remainder Trust vs Charitable Lead Trust

Another kind of split interest trust is a Charitable Lead Trust (CLT). I have a full blog post on CLTs, but the basic idea is that charitable donations are made throughout the term of the trust and the remainder of the trust’s funds go to a non-charitable beneficiary (either you or an heir).

In some ways, a Charitable Remainder Trust (CRT) is the inverse of a CLT. That’s because non-charitable beneficiaries (i.e., you as the donor or your heirs) of a CRT retain the lead income interest, with the remaining assets at the end of the trust term passing to charity, while with a CLT the charitable organization receives the income interest, with the remaining assets at the end of the trust term passing to the non-charitable beneficiaries.

A noteworthy difference between a CRT and CLT is that unlike a CLT, a CRT is tax-exempt, which is why it is ideally funded with appreciated assets that can then be sold inside the trust.

CRTs as Living Trusts vs Testamentary Trusts

Like most trusts, a CRT can either be a living trust (created during the grantor’s lifetime) or a testamentary trust (embedded in the will and only created at the grantor’s death).

When used as a testamentary trust, a CRT can receive your estate’s remaining IRA assets so heirs can receive some income from it before going straight to charity, if you desire. Additionally, these distributions to your heirs can be stretched out over a longer time period than the 10 years within which your heirs are required to fully distribute inherited IRA assets. The drawback to this strategy, of course, is that a testamentary trust is imbedded in the will until your death, so any assets going into the testamentary trust would still have to go through probate.

Charitable Remainder Trust Pros and Cons

A CRT can be an attractive option for otherwise motivated charitable legacy builders who have concerns about inadvertently giving away too much of their assets to charity and exposing themselves to longevity risk, because they can receive the income from the assets for the remainder of their lives before passing it along to their charitable beneficiaries. Additionally, charities benefit even before receiving the gift, because they have time to plan around the gift and lay the foundation for projects and initiatives that may be funded by it.

One caveat with any split-interest charitable trust like CLTs or CRTs is that, since the charitable interest of the trust is considered a gift “for the use of” charity rather than a gift “to” charity, the charitable income tax deduction is limited to just 30% of AGI for cash and 20% for appreciated assets. The good news is that there is a five-year carryforward for any unused charitable deduction.

Is a Charitable Remainder Trust Right for You?

As a disclaimer, the information contained in this post should not be construed as tax or legal advice; please consult a qualified tax or legal advisor for guidance on your specific situation.

While they are not perfect solutions, CRTs can be a useful way to more thoughtfully time income taxation and leverage tax savings to subsidize your charitable giving. If you’re curious to see if a CRT is right for you, Charis Legacy Partners works with every client to create personalized plans for those interested in charitable legacy planning.