A Charitable Lead Trust (CLT) can help you meet multiple legacy goals while also limiting your tax burden, but is it right for you?

For high-net-worth folks with strong inheritance goals and strong charitable goals, one of the biggest estate planning challenges is transferring assets to heirs with as little transfer tax as possible. One potentially attractive tool for helping to achieve this goal is a charitable lead trust (CLT). The distinctive advantage of a CLT is that, in addition to serving as a vehicle through which to make large charitable distributions each year, it allows you to direct the ultimate disposition of the remaining trust assets at the end of the trust term, all while helping you achieve specific tax minimization objectives.

What is a Charitable Lead Trust?

CLTs are a type of split-interest irrevocable trust. This means that unlike a typical trust that has one focus (for example transferring assets to heirs or giving to charitable organizations) a split-interest trust serves both of these interests by transferring assets to both charitable and non-charitable beneficiaries (heirs).

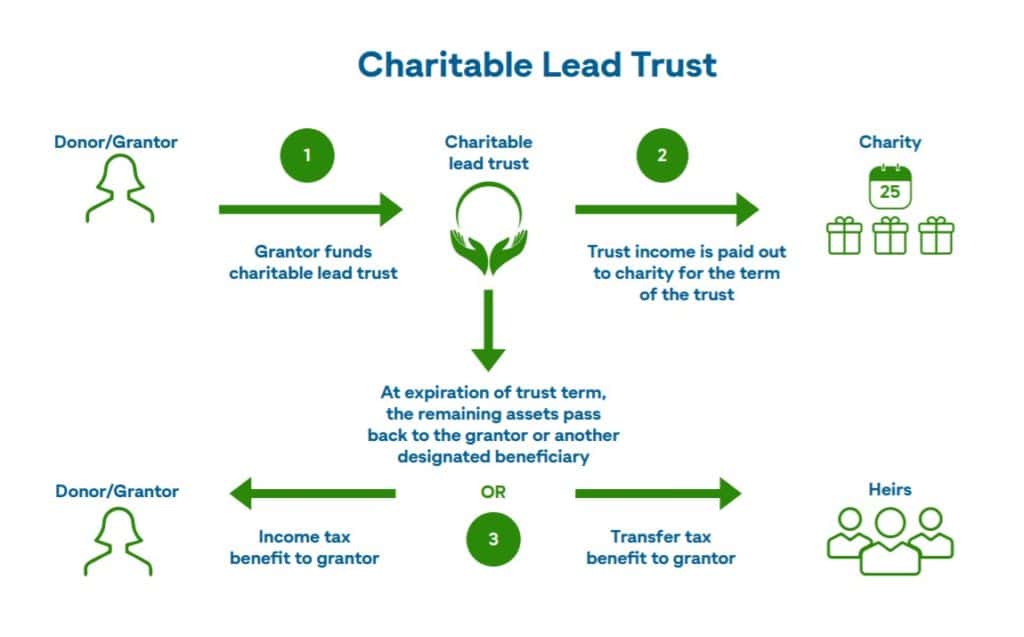

It’s called a charitable lead trust because the charity has the lead interest, while non-charitable beneficiaries have the remainder interest. This means that you, as the grantor, fund the trust with assets that will pay ongoing income out to a charitable beneficiary for a set term. The assets remaining at the end of the trust term revert to you or another non-charitable beneficiary.

How Does a Charitable Lead Trust Work?

We can break down CLTs into three parts: contributions, payments to charity, and distributions to non-charitable beneficiaries.

-

- Contributions

First off, you, as the grantor, must fund the trust. You may do this either during your lifetime or through your will. If these contributions are made in the form of cash, you may be eligible for a partial tax deduction. This deduction is based on many factors, including the trust’s term, your current income tax bracket, and the projected payments the trust will make. You may make contributions to a CLT with non-cash contributions, including stocks, real estate, and other complex assets, though I should note that these assets often come with tax implications. For the record, any time I reference taxes, this should not be construed as personal tax advice. These are general guidelines and before making any personal decisions, you should always talk to your tax advisor first. - Payments to Charity

Next up, you have the payments to the charitable organization that last for the extent of the trust term. The trust term can be your lifetime or a fixed period (for example, 20 years), and charitable income payments can either be a fixed sum or a fixed percentage of trust assets each year. - Distributions to Non-Charitable Beneficiaries

Finally, once the trust term has ended (whether it is for a fixed term or your lifetime) the remainder of the trust is transferred to your designated non-charitable beneficiaries. The transfer taxes at this point are often considerably lower or may even be eliminated entirely. The biggest factor in how transfer taxes apply upon distribution is the type of CLT, which we will discuss next.

- Contributions

There are two main types of CLTs: grantor and non-grantor, the biggest difference between these two being the tax implications of each.

What is a Grantor Charitable Lead Trust?

With a grantor CLT the remaining assets at the end of the trust term revert to the grantor. Grantor CLTs can help address the challenge of too much taxable income in a specific calendar year, because they allow donors to consolidate charitable deductions for future donations into a larger deduction for a single year. Grantor CLTs provide grantors an upfront charitable income tax deduction for the present value of the annual charitable payments (although income generated from the trust assets each year is taxable to the grantor), but they have minimal impact on transfer taxes (because the remaining assets come back into the grantor’s estate at the end of the trust term, so there is little shrinkage of the taxable estate).

Accordingly, grantor CLTs are often funded in years when the grantor has a big spike in taxable income, such as large windfalls from the sale of a business, or other one-time boosts to earnings. In low interest rate environments, the upfront charitable income tax deduction received from a grantor CLT can be 60-70% or more of the initial funding amount. With good investment management over the term of the trust, the donor can be expected to receive much of that original funding back.

What is a Non-Grantor Charitable Lead Trust?

The second and more popular type of CLT is a non-grantor CLT where the remaining assets pass to heirs. Non-grantor CLTs help to address the challenge of too much wealth at death, leading to exposure to transfer taxes, by giving the donor a transfer tax deduction for the present value of the stream of income that will be paid to charity during the trust term.

By strategically structuring the term and the charitable payout, it is possible to receive a transfer tax deduction that perfectly offsets the trust funding amount.

These assets pass on to heirs at the end of the trust term, so this is a good way to meet charitable goals while also shrinking taxable estates through transfer tax-free asset transfers to heirs. No income tax reduction benefit is provided, but in contrast to the grantor CLT, the annual income produced by the trust assets is not taxable to the grantor.

Advantages of a CLT

The biggest advantage of a CLT is its ability to reduce your tax burden, with the specific tax benefits depending on the type of CLT in question and whether the money is distributed to non-charitable beneficiaries during your lifetime or after.

If you have a non-grantor trust and the trust term ends during your lifetime, you may have to pay gift taxes, but as previously mentioned, there are ways to structure the trust in such a way that minimizes or even eliminates gift taxes on the amount passed on the non-charitable beneficiary.

If the term of the trust is your lifetime, then a non-grantor trust can potentially reduce estate taxes payable upon your death, while also preserving wealth for future generations, since your estate will be eligible for an estate tax charitable deduction, based on the amount of payments made to charitable organizations during the term of the trust.

Additionally, because the charitable beneficiaries of the trust enjoy the certainty of a fixed stream of funding, CLTs can be a good vehicle for long-term charitable commitments and endowment funding.

CLTs and Donor-Advised Funds

Depending on the type of CLT, it can be challenging or impossible to change charitable beneficiaries after the trust is established, and at the very least may require an amendment to the trust. In order to preserve greater flexibility here, a Donor Advised Fund (DAF) can be a good complement to a CLT. By designating the DAF as the sole charitable beneficiary of the CLT, you can then advise the DAF to make grants to the charities of your choosing and change those charities at any time.

Is a Charitable Lead Trust Right for You?

Charitable legacy planning is incredibly personal and there is no one size fits all approach. That being said, depending on your financial legacy goals, CLTs can be an excellent option to consider, especially if you have both charitable legacy and inheritance goals.